Best UK Business Bank Accounts for Expats: A Comprehensive Guide

Navigating the UK Business Banking Scene as an Expat

Starting a business in the UK is an exciting venture, but for many expats, the initial hurdle is often opening a business bank account. The UK banking sector is robust, yet traditional banks can be quite stringent regarding residency status and credit history. Fortunately, the rise of fintech and digital-first banks has opened doors that were previously locked to newcomers. Whether you are a digital nomad or a newly arrived entrepreneur, finding the right financial partner is crucial for your success.

Why Choosing the Right Account Matters

For an expat, your business bank account isn’t just a place to store money; it’s a tool for international growth. You need a platform that handles multi-currency transactions efficiently, integrates with local accounting software like Xero or FreeAgent, and, most importantly, accepts applications from those with limited UK address history. A poor choice could lead to high foreign exchange fees or, worse, a frozen account during a critical transaction.

Top Digital Banking Solutions for Expats

Digital banks, or ‘neobanks’, have revolutionized the way foreigners do business in the UK. They offer faster onboarding, lower fees, and more flexible criteria than their high-street counterparts.

Revolut Business

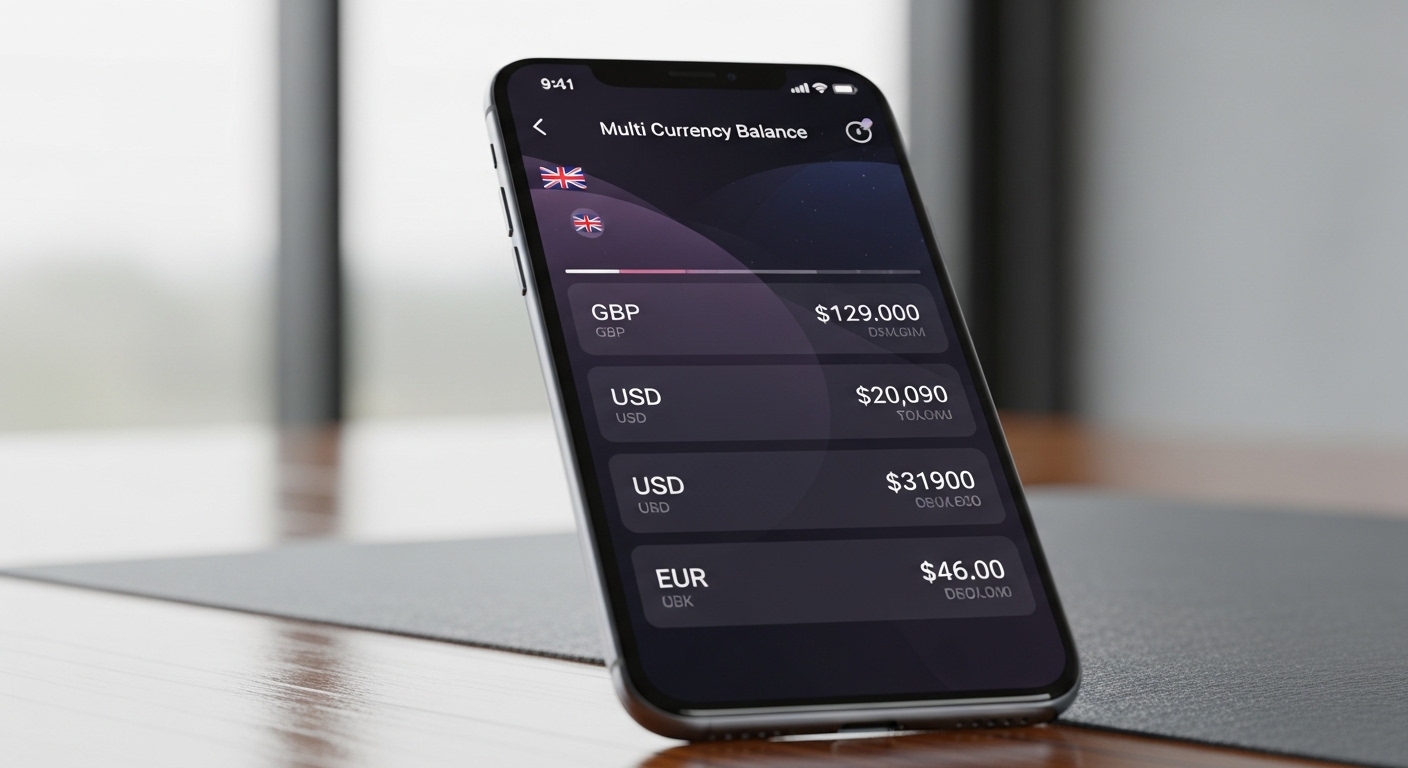

Revolut is a titan in the digital banking space and a favorite for many expats. Its biggest draw is the multi-currency accounts. You can hold, receive, and exchange over 25 currencies at the interbank exchange rate. This is particularly beneficial if you are sourcing products from abroad or serving international clients, as it minimizes the sting of currency conversion fees.

Wise Business

While technically an Electronic Money Institution (EMI) rather than a full bank, Wise is indispensable for global entrepreneurs. It provides local bank details for the UK, Eurozone, US, Australia, and more. This allows you to receive payments like a local, which is a game-changer for maintaining professional relationships with international vendors.

Monzo Business

If you have already established some residency in the UK, Monzo is a fantastic choice. Their interface is incredibly user-friendly, and their ‘Tax Pots’ feature is a life-saver for the self-employed. It automatically sets aside a percentage of your income for HMRC, helping you stay prepared for tax season without any extra effort.

Challenges with Traditional High-Street Banks

Names like HSBC, Barclays, and Lloyds are prestigious, but they often present significant barriers for expats. They typically require a face-to-face meeting and a solid UK address history—often three years or more. While these institutions offer more comprehensive lending products and physical branches, the application process can be slow. However, if your business requires complex financing or physical cash deposits, they remain a necessary option to consider once you are settled.

Essential Requirements for Expats

To streamline your application, whether digital or traditional, you should have the following documents ready:

– Proof of Identity: A valid passport or national ID card.

– Proof of UK Address: A utility bill, council tax statement, or rental agreement.

– Company Details: Your Certificate of Incorporation from Companies House and your UTR number.

– Business Plan: A brief overview of your operations and expected annual turnover.

Making Your Final Choice

Selecting the best account depends on your business model. If you deal with multiple currencies daily, Wise or Revolut are likely your best bets. If you want a more traditional UK banking experience with modern perks, Monzo or Tide are excellent alternatives. Take the time to compare fee structures and integration options to ensure your chosen bank can scale alongside your business ambitions. Cheers to your new UK venture!